Life Sciences – Aurex Group Insights into this growing industry

The Life Sciences industry has been steadily gaining attention and its expansion has created a vibrant ecosystem of innovation and growth globally. Life Sciences encompasses a wide range of sectors that include healthcare, research & development (R&D), AI and manufacturing.As an asset class, Life Sciences real estate takes various forms. The most significant is combined…

Key influences on Life Sciences growth in the last few years

The healthcare sector was one of the biggest influences for growth in this space, especially with the development and sale of Covid-19 vaccine. To complement this, the influx of venture capital during the pandemic powered Life Sciences sector growth from 2020-2022. However, with the pandemic now under control, growth of major Life Sciences companies has begun to normalise. Global venture capital funding for the Life Sciences sector weakened in 2022, with the US and China being the most impacted markets.

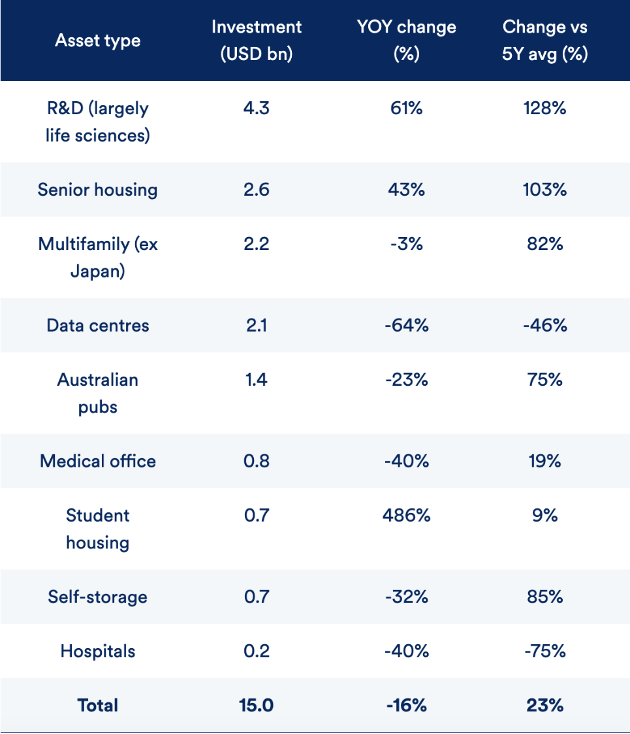

Despite the slowdown, the growing popularity of the alternative real estate asset class will drive the longer-term growth of the Life Sciences real estate sector across APAC. The largest alternative sector in 2022 was R&D assets (largely in Life Sciences), with investment rising 61% to USD 4.3 billion. The second largest alternative sector was senior housing, with investment rising by 43% to USD 2.6 billion in APAC.

Figure 1: Courtesy of Schroders

The pandemic highlighted the importance of Life Sciences globally. Venture capital is targeting innovation and ideas, real estate investors are capitalising on the demand for new high-tech facilities.

Every $1 billion of Series A venture capital funding into Life Sciences equates to approximately 140,000 square feet of demand for space created. (Savills)

North America has been the most popular destination for Life Sciences real estate investment but there is growing investor interest in Life Sciences assets in APAC. According to CBRE’s 2023 Investment Intentions survey, Life Sciences was named as the most popular alternative sector for investment. Types of Life Sciences related assets include healthcare related properties and medical offices.

Significant funds have been raised but investment remains lower than expected due to limited availability in investor grade assets, certainly when compared to North America.

Between 2018 – 2022 a total USD17.6bn has been raised for APAC investment in comparison to USD 69.1bn raised of North American investment. And APAC Life Sciences real estate investment only made up 1% ($717m USD) of total real estate investment in 2022.

As of the end of 2022, there was more than 100 million square feet of R&D laboratory space in Asia Pacific. Solid leasing demand is driving the emergence of new Life Sciences hubs. (CBRE)

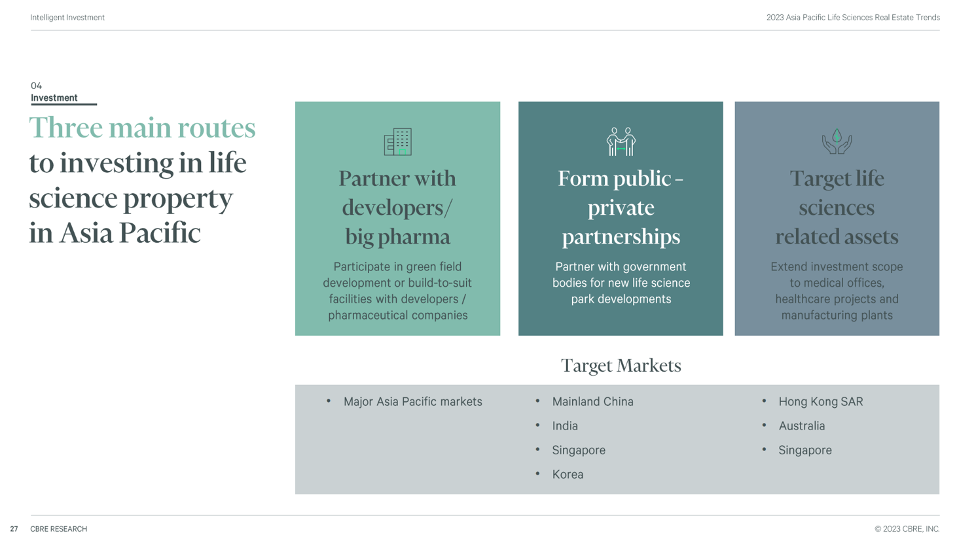

The most common approach by investors was to enter the market through JV’s. Life Sciences real estate assets are highly specialised and so there is a significant barrier to entry. Investors have opted to leverage partners with operational expertise.

Figure 2: Courtesy CBRE

Cities in China have begun to emerge as global leaders in Life Sciences, including Shanghai, Beijing, and Suzhou. Investor interest in Shanghai is highest (in China) due to a higher availability of emerging and mature Life Sciences clusters and assets.

Louisa Luo, Head of Industrial and Logistics, Savills China, says, “The Chinese government is investing increasing amounts into research and development in order to build up scientific and technological self-reliance. The home market is large and growing rapidly – a result of the aging population, increases in lifestyle diseases, rising affluence and a willingness to spend more on health and wellness.” (Savills)

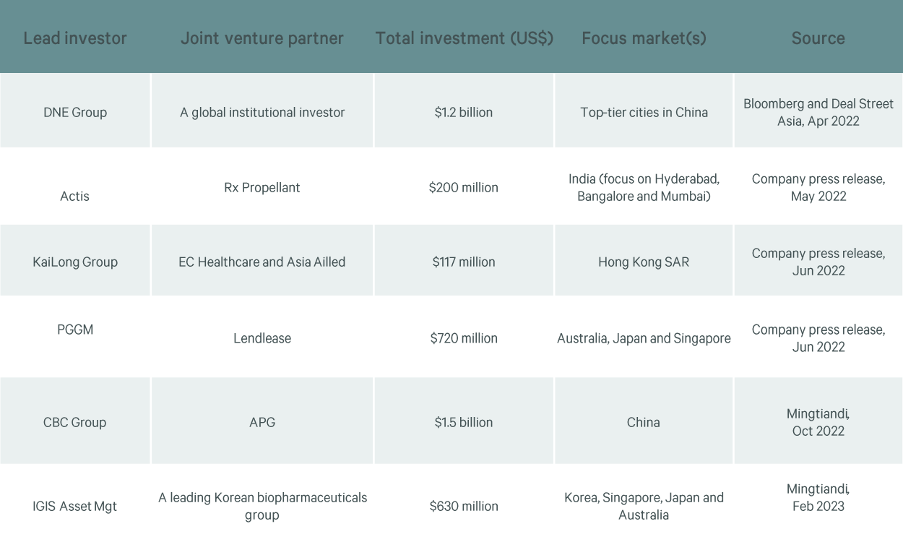

As a result Greater China is the focus for investors with funds being raised by CBC Group, Hillhouse (Gao Yue), Sequoia and DNE Group. But significant capital has also been raised for investment in Korea and Japan by the likes of IGIS and AXA and Singapore and India have had the likes of Actis, PGGM and Lendlease as investors.

Figure 3: Courtesy CBRE

Cluster growth in APAC

In recent years have seen the proliferation of Life Sciences clusters in APAC which aim to support R&D operations of both local and multinational firms. These clusters are situated in gateway cities, with China, India and Singapore owning the largest quantum of R&D space. As of the end of 2022, the total leasable area of R&D and Life Sciences related real estate in exceeded 100 million square feet.

In Japan and Australia, R&D projects are commonly sponsored by universities and major hospitals, which results in limited availability of leasable R&D space on the open market is limited.

In APAC, the largest Life Sciences cluster is probably “Pharma Valley” in Shanghai’s Zhangjiang Hi-Tech Park. Similar clusters have emerged in Beijing, Singapore, Seoul, Sydney, and other cities, all located in business parks.

In Australia, NorthWest Healthcare REIT (Australia’s largest current owner in the sector) recently celebrated its official sod-turning ceremony in May on the Gold Coast, unveiling exciting opportunities for investors, developers, and occupiers alike. The $154-million research excellence centre, “RDX Lumina”, broke ground at the internationally recognised Gold Coast Health and Knowledge Precinct, located within the Queensland State Government’s 9.5ha health and knowledge focused commercial cluster, Lumina.

China Life Sciences sector has been noted for its dynamic growth within APAC, and Shanghai has been identified as the city with the highest investable stock. Therefore, it seems reasonable to focus on the Shanghai market for investment opportunities. In China, value-add investors may potentially divest stabilised assets to C-REITs or perhaps insurance companies. In other regions within APAC, Core or Core Plus funds are likely to be the preferred choice of buyers.

Sub-regional Challenges

Conversion from business parks to combined office/laboratory buildings face various practical challenges. A key one is regulation. In Singapore, while the government highly value the Life Sciences industry, they classify business park assets as industrial property, subject to land leases managed by JTC which create limitations on how investors hold the assets. Another challenge is a preferred proximity to the core clusters. In Shanghai, there is very low vacancy in Pharma Valley in Zhangjiang. While the city government have five additional areas for Life Sciences expansion, many occupiers would be unwilling to move as they may lose employees. Owners of Life Sciences assets in the new districts may struggle to attract tenants.

In certain cities, there are no Life Sciences stock with Tokyo being notably absent from the list. This is not because Japan lacks a Life Sciences sector. On the contrary, the pharmaceuticals industry is very well-established, however in Japan, research is largely sponsored by universities and hospitals, leading to a decline in demand for leased laboratory space from start-ups. According to reports, some investors in Japan have attempted to implement Life Sciences projects on standalone buildings, however the success of this approach seems limited, given the significance of clusters in the sector.

Major plans exist across APAC for development of new Life Sciences parks or expansion of existing parks across China and Korea, so investable stock should increase over time. However, there is caution about the growth plans for Life Sciences in Hong Kong, who are quite a belated entrant into this sector, and it may take time for an active investment market to emerge in Japan in particular.

Impact on Logistics

The growth of the Life Sciences industry has had a profound impact on various sectors, particularly logistics. With the increasing demand for timely and efficient delivery of healthcare products, logistics providers have had to adapt and develop specialized capabilities. Temperature-controlled supply chains, cold storage facilities, and stringent quality control measures are essential to ensure the integrity and efficacy of sensitive medical products. The logistics sector has become an integral part of the Life Sciences ecosystem, playing a crucial role in delivering medicines, clinical trial materials, and diagnostic equipment across the region.

Some key takeaways:

- Life Sciences companies in APAC continue to display demand for laboratory space to support R&D activity.

- Strong demand and limited availability pushed up rents for laboratory space in China, Singapore, and India by a range of 5-30% in 2022.

- As R&D capabilities expand, new manufacturing plants that utilise digitalisation and other innovations are being built across the region.

- Along with India and China, Singapore is emerging as a hotspot for new healthcare manufacturing plants.

To find out more about this latest insight from Aurex Group, please connect with our team.

References:

- Healthcare-related real estate: attractions and challenges – Schroders, 4th Apr 2023, Andrew Haskins

- 2023 Asia Pacific Life Sciences Real Estate Trends – CBRE, 23rd Mar 2023

- Australian Life Sciences Boom Fuels Lumina Space Demand – The Urban Developer, 5th Jun 2023

- Australia’s Life Sciences Industry to Get Next-Gen Skilled Workers – Mirage, 5th May 2023

- Three trends shaping the life science real estate sector – Savills, May 2022, Paul Tostevin & Eri Mitsostergiou

Aurex Group can help

If you are a company considering hiring, we welcome the opportunity to present our services and capabilities. If you are a candidate, please check our jobs page or contact us to discuss your background, skills, and future aspirations. We always look forward to staying connected and exchanging ideas, insights, and opinions.

Sign-up to receive our monthly newsletter straight to your inbox.